Addressing America’s Financial Problem: Education and Credit Line Banking as Catalysts for Change

The financial problem in America is reaching alarming proportions. The nation finds itself burdened by trillions of dollars in debt, with personal credit card debt exceeding $1 trillion and steadily increasing, alongside trillions of dollars in mortgage debt. While it...

Don’t let fear, or anyone else, dictate your financial future

TruthInEquity.com and our comprehensive banking strategy, Credit Line Banking© is designed to help individuals face their fears, take real control over their finances, and launch a financial legacy that will forever change the financial trajectory of their family....

The banking strategy that produces tax free returns

The Feds can tax your interest earnings, but they CAN’T tax interest savings. When your money earns interest on the Asset side of the ledger, the Feds consider that income and then tax you accordingly. When your money saves you interest on the Debt side of the...

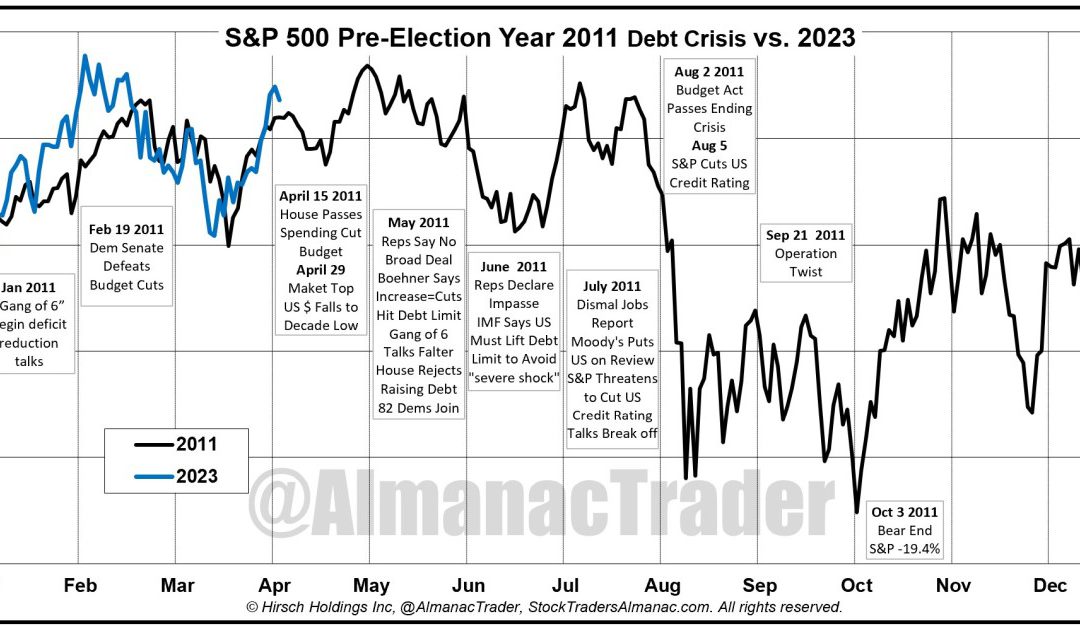

Smart money in 2023…it starts with questioning the status quo!

Welcome to 2023! Good-bye 2022…thankfully! Unfortunately, going in to 2023 the world is a mess, our country is divided like never before and the economy is an absolute disaster. And, as usual, personal finance advice for the New Year is all the rage. No matter the...

Mortgage Broker or Lender? Which is Better for you?

Today, the mortgage industry is filled with numerous companies and individuals that help people in lending money for their biggest investments of life. You will get two sources in the market: a mortgage broker and a lender. Although the two entities equally help you...

The Pros and Cons of a Home Equity Line of Credit

Selling your home profitably could be a considerable boon. Besides that, getting a Home Equity Line of Credit is a major financial decision. You need to decide while you are looking for a loan in the first place; a HELOC provides you with some best options. HELOC is...

How Are Mortgage Rates Determined?

Mortgage interest rates can have a substantial effect on your overall finances of purchasing a home. Nevertheless, your lenders would look for the lowest mortgage interest rates possible. Besides, these lenders must manage their risks with the help of mortgage rates...

Pros and Cons of Tapping Home Equity to Pay Off Debt

You might be considering tapping your home equity to pay your debt off or to consolidate your credit card mortgage. Well, this is an excellent solution to lower interest rates, but you may have to face multiple drawbacks of this process. Borrowers who several lenders...