Your credit score plays a vital role in getting the initial qualification to secure your mortgage loan. Besides, it impacts your down payment requirements, interest rates, and other mortgage terms influentially. Typically, credit score varies from 300 to 850. Thus, if you fall within this range, it means you can be qualified for mortgage loans. The minimum credit score needed depends upon the loan type you require and its insurance.

But what should be the minimum credit score to qualify your mortgage for buying a house in 2021? And what factors affect your credit score before you get into the procedure?

You would get answers to your every query here, but first, you need to get familiar with the term FICO and its significance.

FICO and its Significance

FICO stands for Fair Isaac Corporation, one of the most common scores used by lenders or mortgage institutes to verify creditworthiness. This score aids lenders in calculating the interest rate and the paying fee to get your loan.

FICO is very significant and plays a vital role in mortgage procedure. In this process, the lender must look into various aspects such as your property type, debt level, income, and assets. These factors need to be determined to comprehend whether the mortgager qualifies for the loan or not. These factors should be considered because a precise credit score cannot be identified, which you need to qualify.

Therefore, below are some instructions to help you get on the right track.

Minimum Credit Score for Mortgage Loan

In the United States, the average price to buy a house is approximately 4266,200, and many people do not have that much. Therefore, they need to get a mortgage in order to purchase a new house.

According to the FICO scale, the minimum credit score should be 760 to get the best interest rate on mortgage debt. Although this credit score is considered an outstanding number, the minimum score required in 2021 diverges according to the loan type you applied for.

This score varies if you want to obtain a conventional loan from a private lender, by US departments of Veterans Affairs, or by Federal Housing Administration.

Below is the table of a minimum credit score requirement for different mortgage loan types as per the FICO scale.

| Loan Type | Minimum Credit Score |

| Conventional Loan | 620 (or more depending upon the lender) |

| FHA Loan with 3.5% down payment | 580 |

| FHA Loan with 10% down payment | 500 for Quicken Loans and 90% financing |

| USD-VA Loan | No minimum score (most lenders may require at least 620) |

Conventional Loans

Conventional mortgage loans are loans that are insured by private lenders instead of governmental debt agencies. However, these types of loans follow their loan criteria set by the loan companies such as Freddie Mac and Fannie Mae. These loans are considered more affordable, requiring a minimum credit score of 620 only; however, the down payment varies.

These loans are divided into compatible and non-compatible loans according to whether the debtor obeys the meets the debt standards or not. The compatible mortgage loan follows the principles set by Freddie Mac and Fannie Mae, such as maximum mortgage amounts. In contrast, the non-compatible debt loan does not follow these rules by the organization and may lack or exceed these limitations.

Conventional loans are generally the best option with exceptional credit score, and it tends to offer the most competitive interest rates along with the most suitable repayment method.

The minimum credit score required for a conventional loan is 620 or higher at quicken loans.

FHA Loans

FHA loans are those which are insured by the Federal Housing Administration, and this type of loan is less precarious because it requires less credit score than the conventional ones. The FHA loans require a minimum credit score of 500 with a 10% down payment. However, if you want to obtain a loan with a 3.5% down payment, the credit score needed would be 580. Thus, it enables you to refinance up to 90% of your house’s worth.

USD-VA Loans

The USD-VA can be a smart financial move because this type is only accessible for qualified service members, veterans, and several persisting veteran spouses. This department does not need a minimum credit score not it required down payment. The debtor won’t be charged with any mortgage insurance while getting a VA loan.

However, you need to meet some requirements to get approved for this loan:

- You must be the spouse of a military member who died on active duty or passed away due to some service-related debility.

- You should be a veteran or member of US military reserves or national guards.

Factors Affect Credit Score

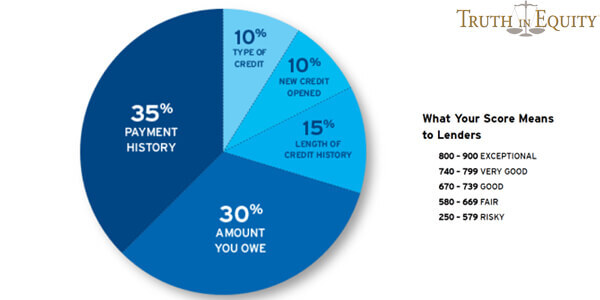

Several factors impact your credit score, which should be recognized before initiating the mortgage process. These aspects can influence your credit scores dynamically, and you can get a great chance to qualify for your mortgage.

The five main factors that go into your determining credit score include:

- Payment history (35%)

- Owed Balance (30%)

- Age of Credit History (15%)

- Credit Mix (10%)

- Recent Credit (10%)

| To reach your credit score, you should check your credit card report or online banking. However, if you cannot discover them, you can visit your banker’s website to get support regarding your credit score. |

Factors Mortgage Lenders Consider

The critical factor to consider by the lender is your credit score. Notwithstanding, there are some other factors which they consider.

-

- Employment History: Lenders often see the employment history of the mortgager for the previous two years. He identifies whether you’ve worked for the same company for the last two years.

- Income: Income is the first thing your lender determines because they want to assure that you make adequate to pay your monthly payments.

- Down Payment: your qualification for a mortgage depends upon your down payment rates. A higher down payment makes a greater chance to be approved for loans and reduced risks for lenders.

-

- DTI Ratio: Lenders also have to look at your monthly debt-to-income ratio, which should be lower. The higher your DTI rate would be, you would strive more to approve for the mortgage.

- Savings: Creditors also see how much savings you carry in case you lose your job; at least you would have your savings to pay mortgage payments.

The Best Means to Enhance your Credit

If your credit scores less than the required score, specific methods can boost your credit score. You can perform the following ways for a quick fix.

-

- Become an Official User: If you become an authorized user of your current credit card account, you would get your own credit card to use. When you make your payment using this credit card, your score will improve automatically.

-

- Pay Bills on Time: When you pay your bills on time every month, it would surely increase your credit score, and spontaneously, it would elevate the chance to get a mortgage.

-

- Monitor your Credit Reports: Order a copy of all your credit reports and analyze them. Examine if there are some errors in it, then try to correct them, and your credit score would rise immediately.

- Pay Off your Credit Debt: If you have any credit debt, try to pay it off as early as possible. Once you have paid off all your debts, your credit score would boost itself.

Verdict

Your credit score varies to purchase a new house in 2021 according to the loan type you want to acquire. Every lender has its own formula to determine how much credit score you require. If you are seeking any support, Truth in Equity is always there to assist you. We help you remain on the right path and comprehend your credit profile.