What’s the Biggest Mortgage You Can Get?

Do you want to purchase or refinance a home in a high-cost market and want an enormous amount of debt? You must determine what option is best for you amongst different mortgage programs and low-interest rates in order to achieve your transaction. However, while buying...

Why are Mortgage Rates Going Up? And How High will they Go?

Mortgage rates have been an upward trend in 2021; so, if you have not refinanced your mortgage or purchased a home yet, you are missing a great opportunity. However, the previous interest rates are not as significant as they are going to be in the future. When it...

Adjustable-Rate Mortgages: The Pros and Cons

An Adjustable-Rate Mortgage (ARM) is a mortgage loan that has an adjustable interest rate. These amendments are made to the interest rates on an installment basis and can be made either monthly or annually. It is a home lean that begins with a low and fixed interest...

Mortgage Acceleration | The truth about your conventional mortgage and a 1st lien HELOC

Whether you are familiar with or brand new to this unconventional concept of paying off your mortgage with a HELOC, it’s important you understand you can’t find everything you need to know on the internet. There’s no way the internet can compensate for your unique...

How to Get Out of Debt Fast With a Low Income?

Being debt-free is a dream which seems impossible for every person who has a low income. but it’s not impossible. By following some strategies and devotion, you can pay your debt off, no matter what your income is. If you pay absolute dedication to this task, you...

Checking Account Vs Savings Accounts–The Pros And Cons

The fundamental difference between the checking account vs. savings accounts is all about how they are being used. These two accounts are considered the most essential financial instruments which are fantastically useful to average users in daily life. A checking...

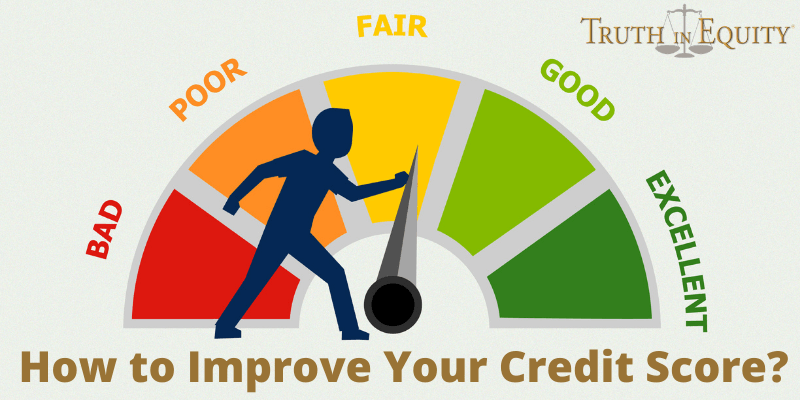

How to Improve Your Credit Score?

Your credit score is one of the most significant measures to see the current financial condition. Most creditors do not approve your loan only if your credit score isn’t adequate, no matter if you meet other criteria. Because it enables the lender to know about how...

Power swap: Equalizing the relationship between you, your bank and your money.

What would happen to the banking community if We the People decided to cash our paychecks instead of direct deposit into a checking account? Every bank in the country would have to shut their doors by days end. They don’t have that kind of cash on hand. If we...